Family Wealth Challenges

The creation of family wealth takes years of dedication, sacrifice, and hard work. Because of this, no family wants to be in a position where they need to create their wealth twice. Instead, they are desperately seeking the financial peace of mind that comes from knowing that their interests are being placed ahead of their professional advisors and that their hard-earned wealth is being prudently stewarded in a manner that makes it sustainable for their lifestyle, family legacy, and philanthropic aspirations.

The challenge for many affluent families, though, is that wealth is not self-perpetuating. Without proper advice, planning, and communication, family wealth is often eroded within 2 – 3 generations. The British proverb, “Clogs to clogs in three generations” is a global phenomenon that appears in every culture.

Research by an independent US family advisory firm studied approximately 2,500 US families, over a twenty-year period, who had owned, sold a business, and gone through a generational wealth transition. The results of this study were that 70% of family wealth transitions failed primarily due to a combination of trust and communications breakdown, inadequate preparation of heirs, and poor governance for the guidance of decision making. Given that the resolution to these issues are all teachable, I’ve always held the view that deficient mentoring is the root cause of family wealth transition failures.

Mentoring Is the Answer

In the trade industries, such as carpentry and plumbing, ‘mentoring’ has been a core component of these careers for many decades as a prudent approach to teach the next generation to become high-quality tradespeople. To solve the behavioural issues in family wealth succession, I believe that the same mentoring approach needs to be adopted.

Mentor definition: those who build and educate people to be better people by helping to shape their philosophies – beliefs and values – in a positive way, often in a longer-term relationship, from someone who has ‘travelled the path before.’

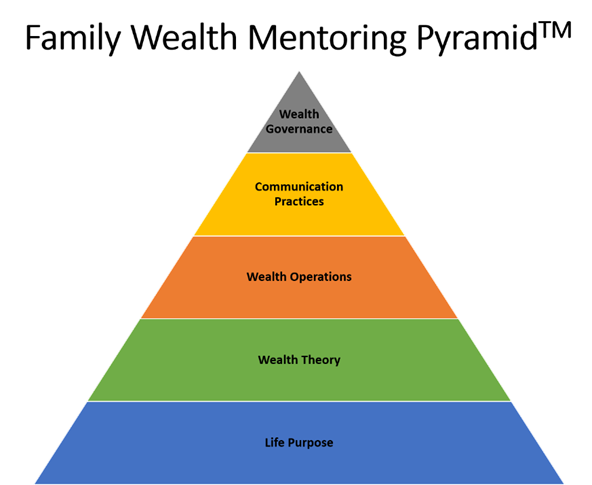

Family Wealth Mentoring PyramidTM

Like any profession, there is a set of knowledge and skills that need to be learned; the family wealth management industry is no different. The goal in mentoring family members is to not try to turn them into ‘wealth management experts’ but to make them highly effective stewards of their family’s hard-earned wealth. The concept of stewardship dates back to ancient times, where the role of a steward was to guard what was entrusted to their care by making wise decisions and protecting from harm. Almost every business concern had a steward who served like a Chief Operating Officer running the daily affairs of the master of the house. Effective stewardship adopts a set of life principles and processes that prepare people to eliminate their greatest dangers, capture their largest opportunities, and maximize their biggest strengths.

For this reason, when mentoring families, I’ve used the Family Wealth Mentoring PyramidTM as a highly effective framework to coach and mentor:

Each member of an affluent family has a unique set of aspirations, knowledge, skills and abilities that first needs to be assessed, with the result being a tailored Family Wealth Mentoring Program for each relevant family member. Typically, though, there are upwards of 5 areas in which they need to be mentored:

Life Purpose:

- Although not a ‘wealth management’ issue, it is a critical ‘family wealth succession’ issue, as members of affluent families cannot be effective stewards of their family’s wealth if they don’t have a defined and established purpose for their lives. Through 30+ years of industry experience, I strongly believe that everyone needs to have a purpose to their lives, as, without purpose, life can lose its meaning, and in its absence, people – especially those who have considerable financial resources – can easily wander through life and become distracted by costly, unproductive, and sometimes unhealthy life choices. As a result, an effective mentor can assist affluent family members to identify a purpose for their lives through a combination of in-depth discussions and various assessment tools.

Wealth Theory:

- Family members need to understand the basics of wealth management encompassing the 3 core areas of investments, insurance, and financial planning. As mentioned above, the goal is to not create wealth management experts, but to develop future family wealth stewards who have a solid understanding of wealth management fundamentals and know what questions to ask.

Wealth Operations:

- The global wealth management industry tends to be a complex one. To be an effective steward, family members also need to understand how the wealth management industry is structured, who are the various participants, what do they each offer, and how do they all ‘fit together’ in the regular operation of the family wealth.

Communications Practices:

- Effective stewardship of family wealth requires regular communication amongst both family members and various wealth professionals such as investment, insurance, planning, accounting, and legal. For this reason, family members who don’t have experience dealing in these complex types of environments often need to be mentored on how best to manage their communication – both written and verbal. Given the complexities of the global wealth management industry, ineffective or misunderstood communication can often result in costly consequences.

Wealth Governance:

- The final area to be mentored is how to organize the ‘collective oversight’ of the family wealth so that the family achieves its long-term aspirations through the intellectual and experiential contributions of the appropriate family members as well as the family’s professional advisors such as investment, insurance, planning, accounting, and legal. Increasingly, many affluent families are establishing ‘Family Wealth Boards’ as a prudent mechanism to ensure effective and efficient governance that significantly increases the probabilities that the hard-earned family wealth will be sustained for multiple generations.

You Reap What You Sow

Like the training required for any profession, success is not achieved in a day or even a month. The positive results of effective mentoring – which lead to prudent stewards of family wealth – take time and are primarily a function of each mentee’s commitment to the mentoring process.

The time and monetary costs of such a mentoring process, though, are a worthwhile investment with significant returns that can result in the preservation of the family wealth for many generations instead of the common erosion of family wealth within 2-3 generations.

“A family can successfully preserve wealth for more than one hundred years if the system of representative governance it creates and practices is founded on a set of shared values that express that family’s differentness.”

James E. Hughes Jr.