Preparation Of Heirs For Inheritances

“A family can successfully preserve wealth for more than one hundred years if the system of

representative governance it creates and practices is founded on a set of shared

values that express that family’s differentness.” – James E. Hughes Jr.

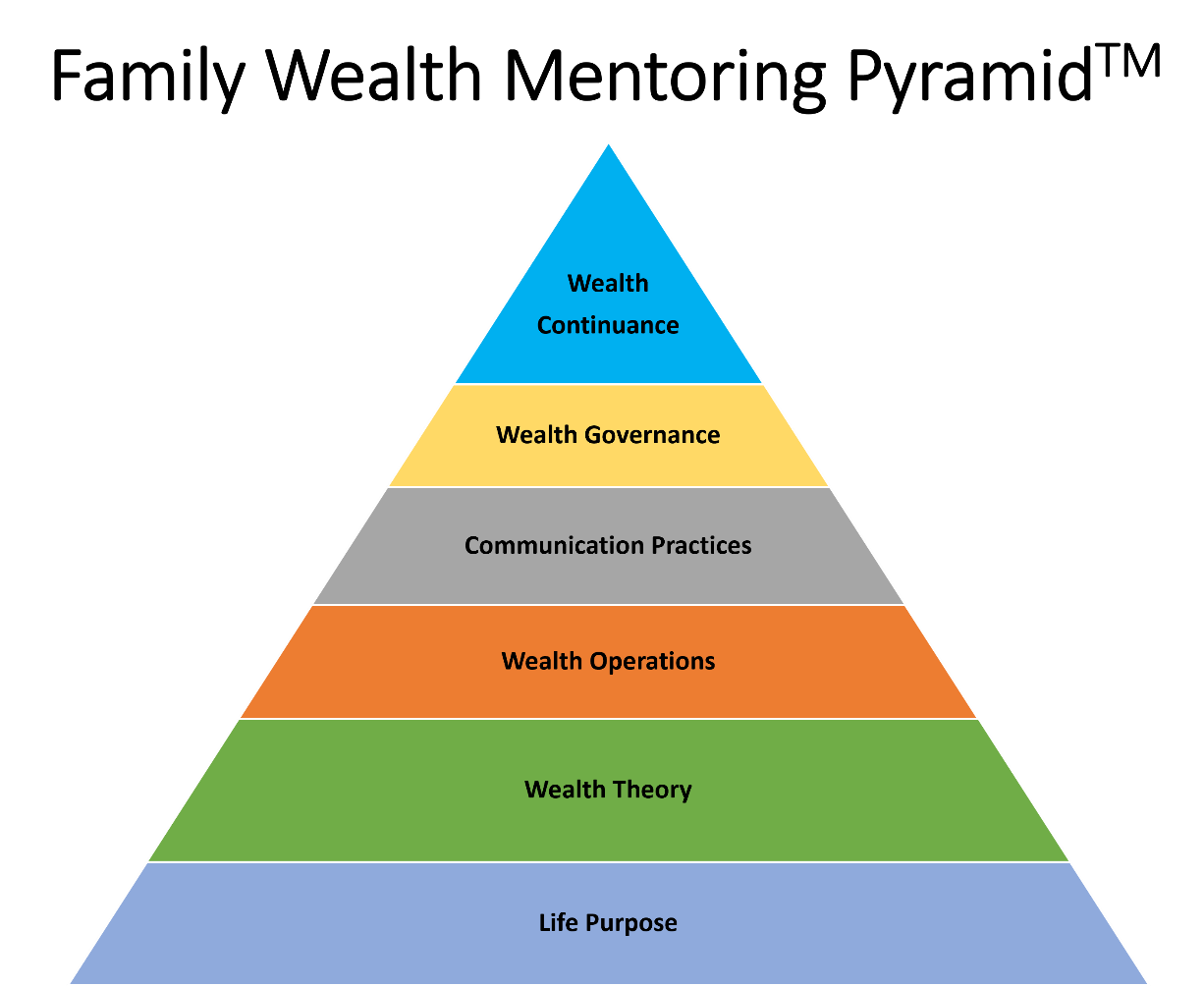

Like any profession, there is a set of knowledge & skills that need to be learned. The family office business is no different. The goal in mentoring family members is to not try to turn them into wealth management experts but to make them highly effective stewards of their family’s hard- earned wealth. For this reason, when mentoring families, I use the Family Wealth Mentoring Pyramid™ as a highly effective framework to ensure heirs are well-prepared to steward their family wealth:

Each member of an affluent family has a unique set of aspirations, knowledge, skills & abilities that first needs to be assessed, with the result being a tailored Family Wealth Mentoring Program for each relevant family member. Typically, though, there are upwards of five (6) areas that need to be mentored:

Although not a ‘wealth management’ issue, it is a critical ‘family wealth succession’ issue as I don’t believe that members of affluent families can be effective stewards of their family’s wealth if they don’t have a defined & established purpose for their lives. Through 30+ years of industry experience, I strongly believe that everyone needs to have a purpose to their lives, as without purpose, life can lose its meaning, and in its absence, people – especially those who have considerable financial resources – can easily wander through life and become distracted by costly, unproductive & sometimes unhealthy life choices. As a result, an effective mentor can assist affluent family members to identify a purpose to their lives through a combination of in-depth discussions and various assessment tools.

Family members need to understand the basics of wealth management encompassing the three core areas of investments, insurance and financial planning. As mentioned above, the goal is to not create wealth management experts but to develop future family wealth stewards who have a solid understanding of wealth management fundamentals and know what questions to ask.

The global wealth management industry tends to be a complex one. To be an effective steward, family members also need to understand how the wealth management industry is structured, who are the various participants, what do they each offer and how do they all ‘fit together’ in the regular operation of the family wealth.

Effective stewardship of family wealth requires regular communication amongst both family members and various wealth professionals such as investment, insurance, planning, accounting & legal. For this reason, family members who don’t have experience dealing in these complex types of environments often need to be mentored on how best to manage their communication – both written & verbal. Given the complexities of the global wealth management industry, ineffective or misunderstood communication can often result in costly consequences.

Governance is about how to organize the ‘collective oversight’ of the family wealth so that the family achieves its long-term aspirations through the intellectual & experiential contributions of the appropriate family members as well as the family’s professional advisors such as investment, insurance, planning, accounting & legal. Increasingly, many affluent families are establishing ‘Family Wealth Boards’ as a prudent mechanism to ensure effective & efficient governance that significantly increases the probabilities that the hard-earned family wealth will be sustained for multiple generations.

To truly address the cross generational sustainability of affluent family wealth, it’s imperative that families identify the roles that future generational family members will perform in the ongoing stewardship of the family wealth. Like any family business, the challenging part of this process is mitigating emotions & biases, and instead focusing upon an objective and competency-based approach that identifies the combination of up to three roles: Who will be ‘operating’ the family office vs ‘governing’ the family office vs a ‘beneficiary’ of the family wealth.

Like the training required for any profession, success is not achieved in a day or even a month. The positive results of effective mentoring – which builds prudent stewards of inter-generational family wealth – takes time and is primarily a function of each mentee’s commitment to the mentoring process.