Formation, Growth & Governance of Family Office Businesses

“A Family Office is the organization that is created, often after the sale of a family business or realization of significant liquidity, to

support the financial needs of a specific family group. The goals and needs of the family shape the office, making each office

unique in their approach to life and wealth management.” – Family Office Exchange

Family Office Businesses are unique amongst wealth management firms due to the levels of complexity that exist within families of significant means. To address these complexities, affluent families have had to surround themselves with several professional practitioners – such as accountants, investment managers & lawyers – to provide the technical expertise in each specific area such as estate laws, tax laws, tax accounting, risk management and investments. Often it has been left to the families to try to synthesize the various solutions provided to them, but unfortunately, most often they remained unintegrated. As a result, family office businesses can provide the coordination & cohesiveness of professional advice.

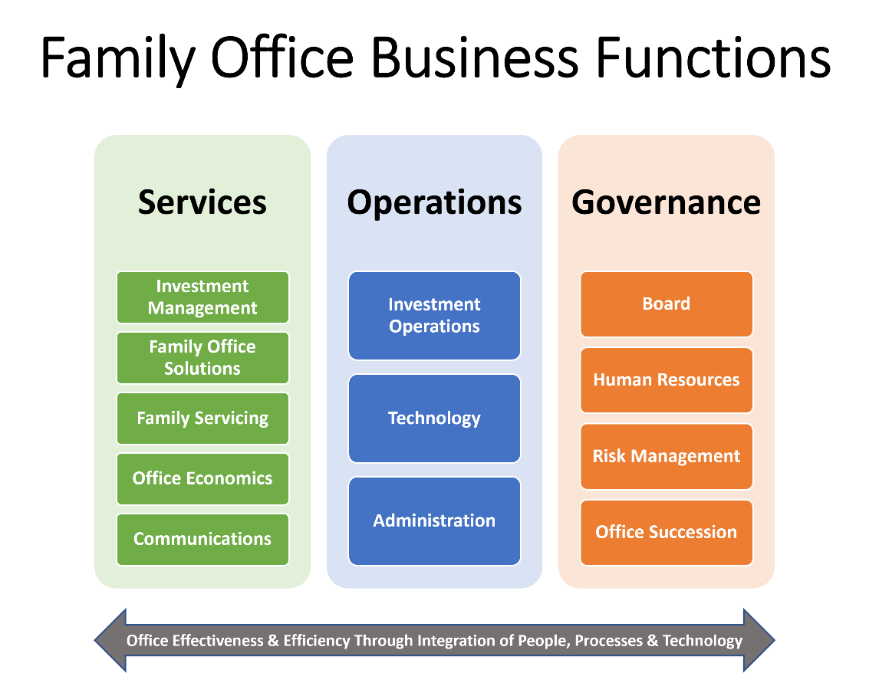

To accomplish this, as well as support the long-term sustainability of family wealth, all well-designed Family Office Businesses – whether Single, Multiple, or Virtual – are comprised of three broad functional areas containing upwards of twelve elements that need to be designed, implemented, managed & monitored, as illustrated in the image below. My professional experience & expertise is in the design, implementation, management & governance of Virtual Family Office solutions for affluent families and family wealth businesses.